The Secret Of Info About How To Increase Tax Withholding

Line 4 (a) increases the amount of income subject to withholding.

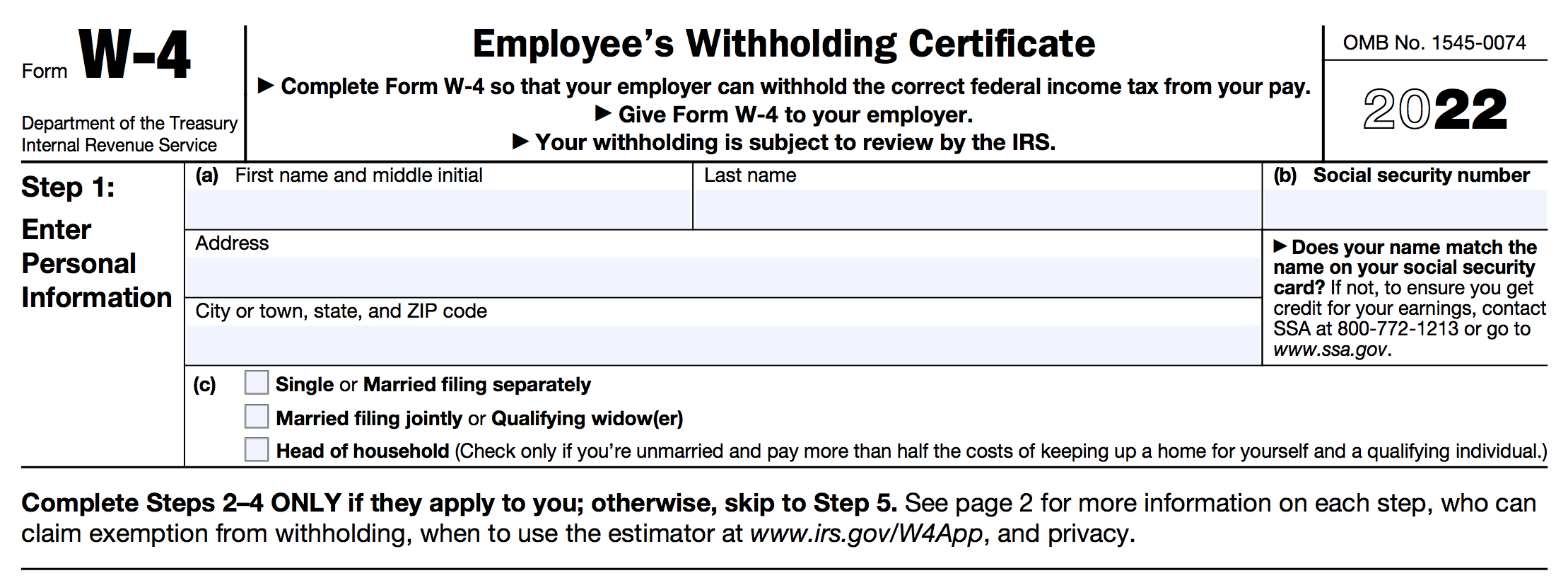

How to increase tax withholding. Use the same tax forms you used the previous year, but substitute this year's tax rates. To change their tax withholding, employees can use the results from the tax withholding estimator to determine if they should complete a new form. (if you are deaf or hard of hearing, call the irs tty number, 1.

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. Sign in to your online account go to opm retirement services online click federal tax withholdings in the menu to view, stop, or change your current federal withholdings make sure. Line 4 (b) decreases the amount of income subject to.

To use these income tax withholding. Only need to adjust your state withholding allowance, go to the employment. One way to adjust your withholding is to prepare a projected tax return for the year.

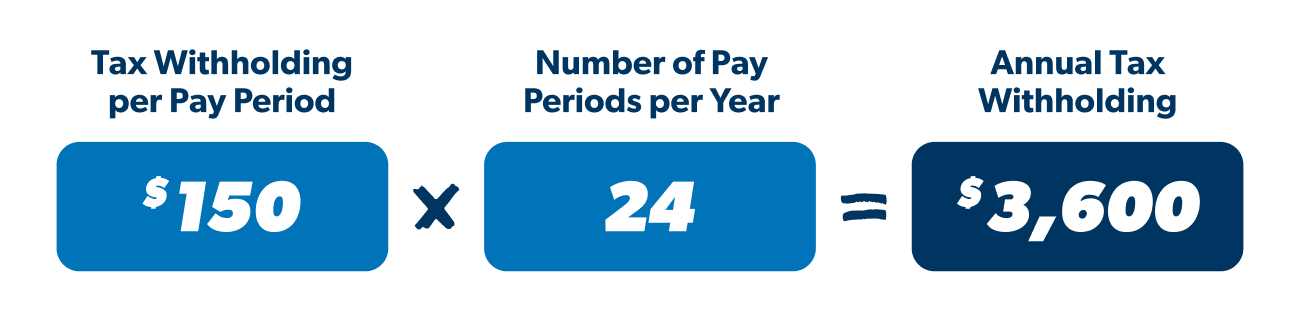

If too much tax is being taken. There are two main methods for determining an employee’s federal income tax withholding:. The commonwealth deems the amounts withheld as payment in trust for the employees' tax.

If you’re already receiving benefits, you’ll have to ask social security to start withholding taxes. To adjust your withholding is a pretty simple process. Line 4 (c) increases the amount of tax withheld.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)