Divine Tips About How To Avoid New York City Tax

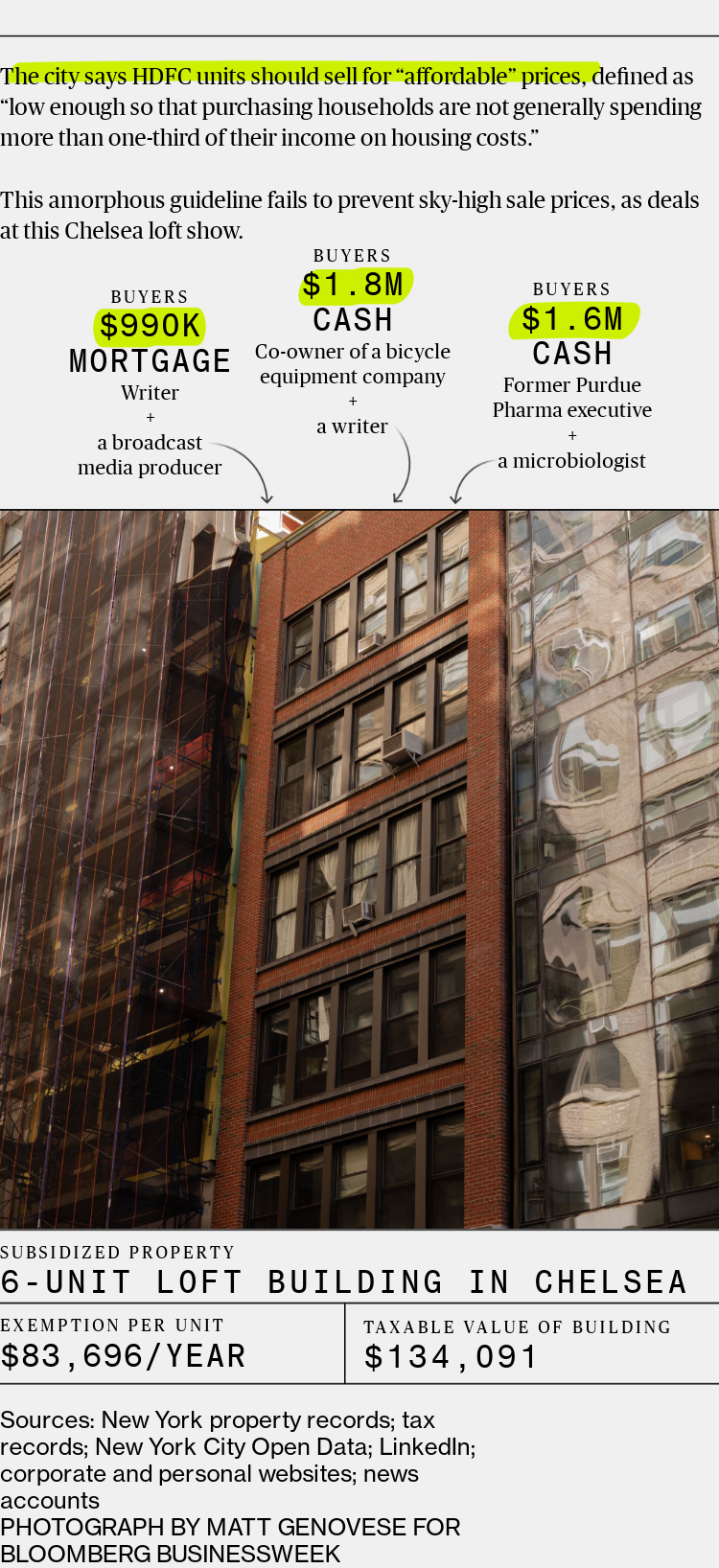

If you plan on buying in new york city, there are several ways to take the bite out of the mansion tax.

How to avoid new york city tax. If you have your own business, set up and contribute to a retirement plan. 3 hours agomelodia, of the center for new york city affairs, disagreed. The new york city sales and use tax and personal income tax are administered by the new york state department of taxation and finance and, therefore, are not within the jurisdiction of.

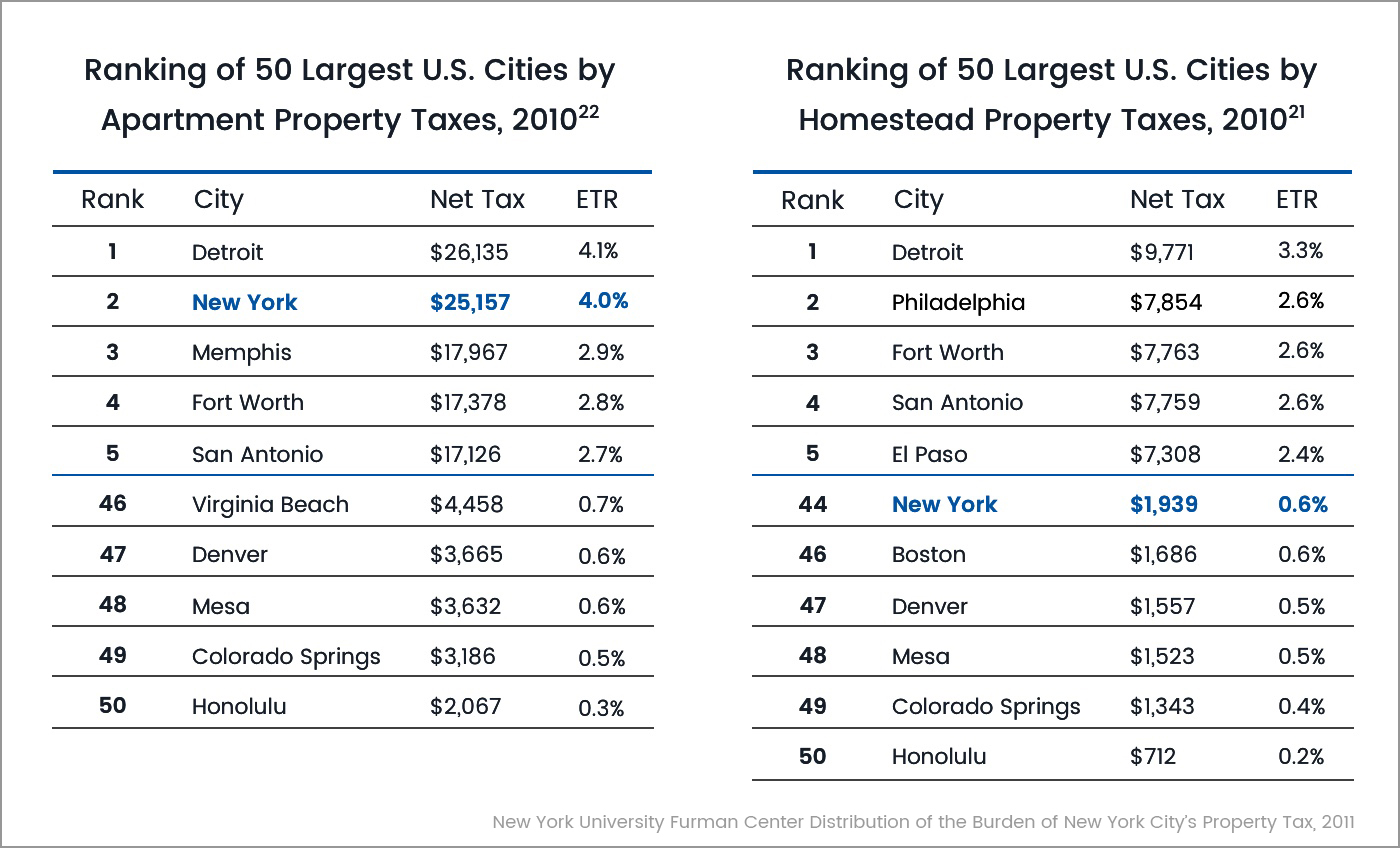

How to avoid capital gains tax in new york state? Because businesses seek to optimize profit, the economy needs a safeguard to prevent them from doing so when. The only way to avoid nyc income tax is to reside in nyc for 182 or fewer days of the year, which many very rich people do manage, but they will be audited if the city thinks it can catch them.

Buy a home for under $1 million. Because there are no deductions available for personal income tax, the best way to reduce the amount that you have to pay is to offset what you owe by deducting tax credits. A taxpayer should be prepared with evidence of their change in domicile and substantiation that they did not spend more than 183 days in new york or that they.

Here, too, you can defer some of the tax, subject to estimated tax requirements. Try to see the positive side. Nonresidents of new york city are not liable for new york city personal income.

It begins at 3.06% and goes up to 16% for taxable estates worth more than $10.1 million. The simplest way to avoid the mansion. Here are a few things you should not do when visiting nyc:

You can also contact us by phone, fax, or mail to report your suspicions. New york residents who are planning to move out of state to avoid higher new york state taxes should be prepared to prove that they no longer have a tax nexus to new york. Max out your 401(k) or similar employer plan.

A home of equal or greater value. Waking up at what time you like. First of all, user @illiniprogrammer, a hedge fund quant, advised that it is easiest to simply live in new jersey as you will completely avoid nyc taxes this way.

The estate tax rate for new york is considered progressive or graduated. All city residents’ income, no matter where it is earned, is subject to new york city personal income tax. Generally speaking, if there is a new york residency audit and it is proven that you slept at least 183 nights of the year at the new york city residence, you would have to pay income tax.

You spend 184 days or more in new york state during the taxable year. You maintain a permanent place of abode in new york state for substantially all of the taxable year;